Singapore’s economy grew by 3.2% in 2018 as compared to 2017.

The Singapore’s budget 2019 has stated that in the next three years, $3.6 billion would be committed to assist workers during industrial disruptions and $1 billion would be engaged in enabling companies to grow their deep enterprise capabilities.

Enterprise Singapore (ESG) would also be streamlining their eight financing programmes into a single scheme in October 2019. The scheme would cover working capital, fixed assets, venture debt, trade, mergers and acquisition as well as project financing.

The government would also be taking on a maximum of 70% of the risk for bank loans as compared to the maximum risk of 50% in the previous years.

SMEs and larger firms will be provided with customised support due to the different scale and industry the organisation is.

There are many other benefits of registering a company in Singapore.

Company Vs Sole Proprietor in Singapore

Legal Entity

Companies

Having a separate legal entity would mean that the company would acquire assets, sued or be sued, enter into loan agreements and contracts in its own name and not the shareholders and its directors.

Sole Proprietors

While sole proprietorship is not a separate entity on its own, the owner would own the entire assets and liabilities of the business personally. This would also mean that the sole proprietor would have unlimited liability.

Liability

Companies

Having a limited liability would mean that the amount the members have to contribute to the liabilities of the company would be what is agreed initially as the capital. This would serve as a protection for the personal assets of the members of the company.

Sole Proprietors

Sole proprietors has a great risk exposure as they have unlimited liability in the business. This would mean that your personal assets would also be subjected to the risks and debts of the business. Debtors can come after your personal assets in situations of insolvency.

Tax Rates

Companies

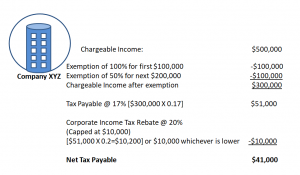

Qualifying companies have tax exemptions for the first three consecutive years of assessment. There will be a full exemption on the first $100,000 of normal chargeable income and a further 50% exemption on the next $200,000. However, there will be a change of the exemption from YA2020 onwards. The first $100,000 chargeable income would then have a 75% exemption and a further 50% exemption on the next $100,000.

| YA2019 and Before | YA 2020 Onwards | |

| First $100,000 Chargeable Income | 100% | 75% |

| Next $100,000 Chargeable Income | 50% | 50% |

| Following $100,000 Chargeable Income | 50% | – |

There will also be a Corporate Income Tax (CIT) rebate at 20% which is capped at $10,000 for YA 2019.

Sole Proprietors

Sole proprietors are taxed based on personal income tax rates and not the corporate tax rates. The personal income tax rates are progressive as an individual who earns a higher income pays a proportionately higher tax. Therefore, the higher the income of Sole proprietors, the higher the tax amount that needs to be paid.

| Chargeable Income |

Rate | Gross Tax Payable | |

| $ | (%) | $ | |

| On the first | 20,000 | 0 | 0 |

| On the next | 10,000 | 2.0 | 200 |

| On the first | 30,000 | 200 | |

| On the next | 10,000 | 3.5 | 350 |

| On the first | 40,000 | 550 | |

| On the next | 40,000 | 7.0 | 2,800 |

| On the first | 80,000 | 3,350 | |

| On the next | 40,000 | 11.5 | 4,600 |

- Note that there still more tiers for individual tax rates and also tax reliefs for individuals.

CONFUSING? Let’s illustrate the calculations!

Companies

Company XYZ has a chargeable income of $500,000 for YA 2019.

Financial support

Companies

There are many grants for companies and start-ups. One of the start-up grants include Startup SG Founder which purpose is to encourage entrepreneurs to take their first step in executing innovative concepts. The grant amount would be up to $30,000, matching $3 to every $1 raised by entrepreneurs. There would be requirements specific to the application of the grant.

Sole Proprietors

Sole proprietors would not be eligible to any grants.

Capital

A company can invite investors by issuing shares to them. This would enable the company to raise capital. Also, banks would be inclined to provide loan to companies as compared to individuals.